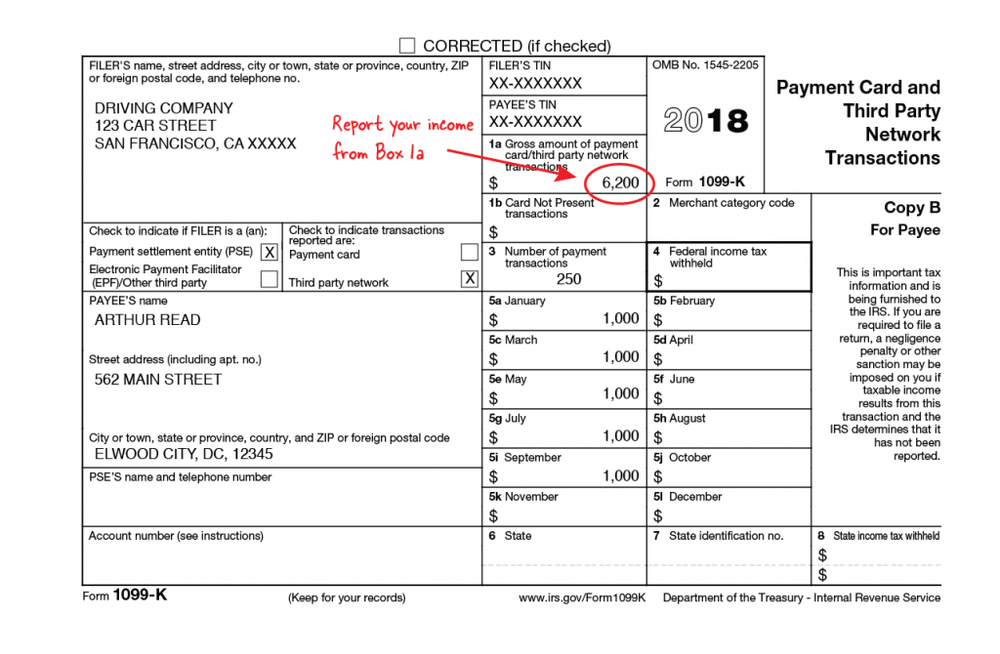

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Independent Contractor The relationship between Contractor and Eastmark is that of an in tangible form shall be returned immediately to the disclosing partySimply use the postal mailing feature to have TaxBandits print and mail hard copies of Form 1099NEC to each of your recipients Payments through thirdparty networks, including credit card payments, are reported on Form 1099K If, for example, a business pays an independent contractor through PayPal, the contractor may receive a Form 1099K from PayPal for those direct sales Issuing a 1099K depends on the number of transactions and the total dollar amount paid

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

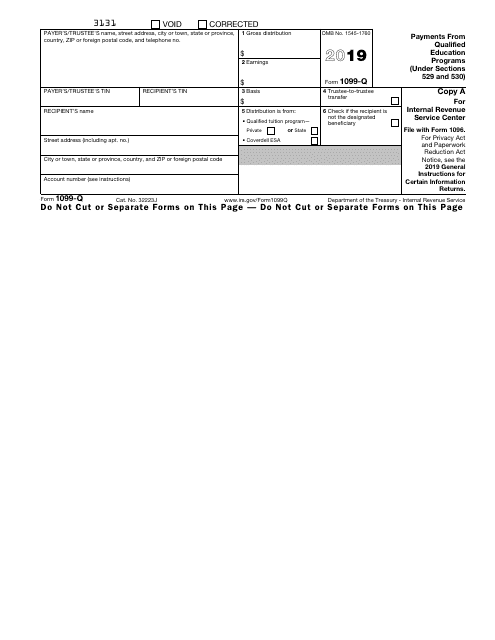

1099 form independent contractor example

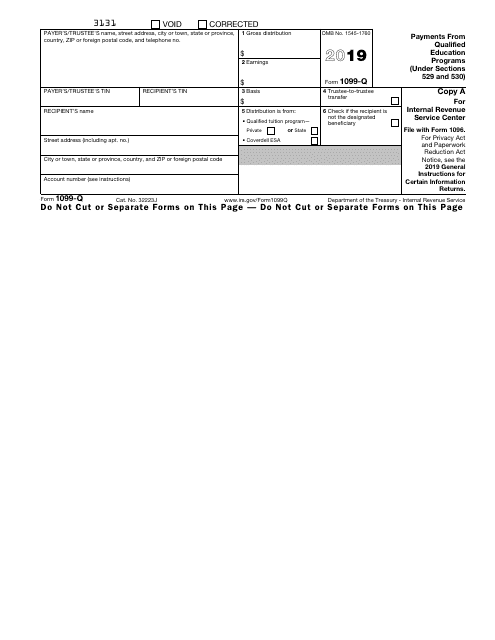

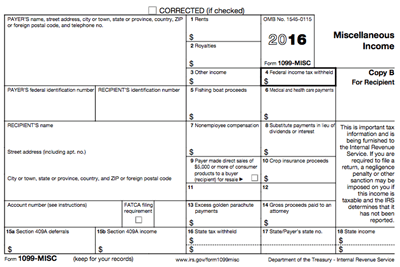

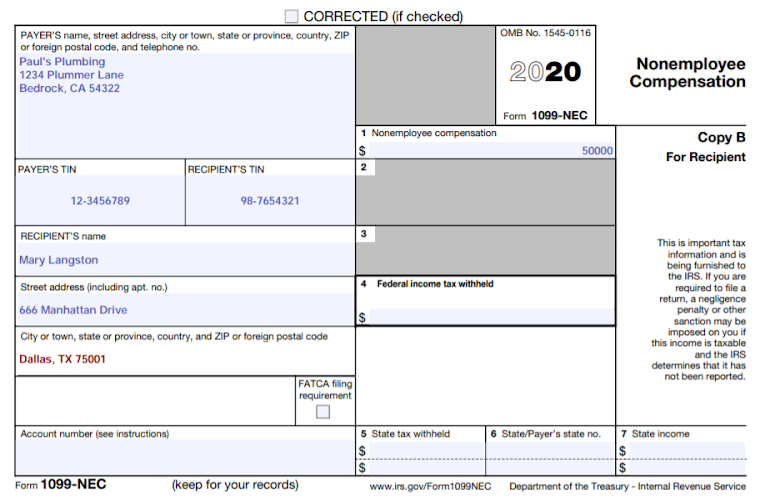

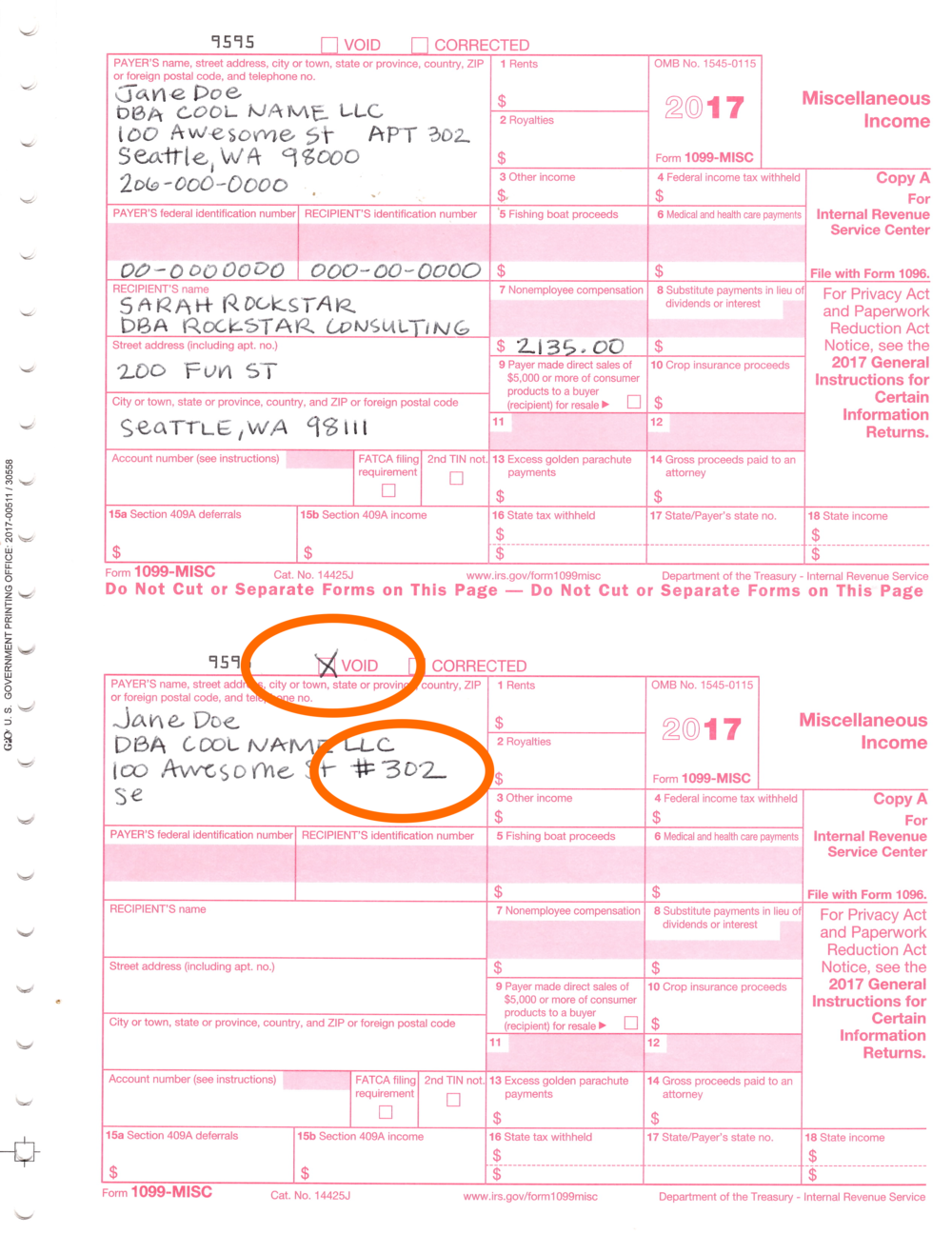

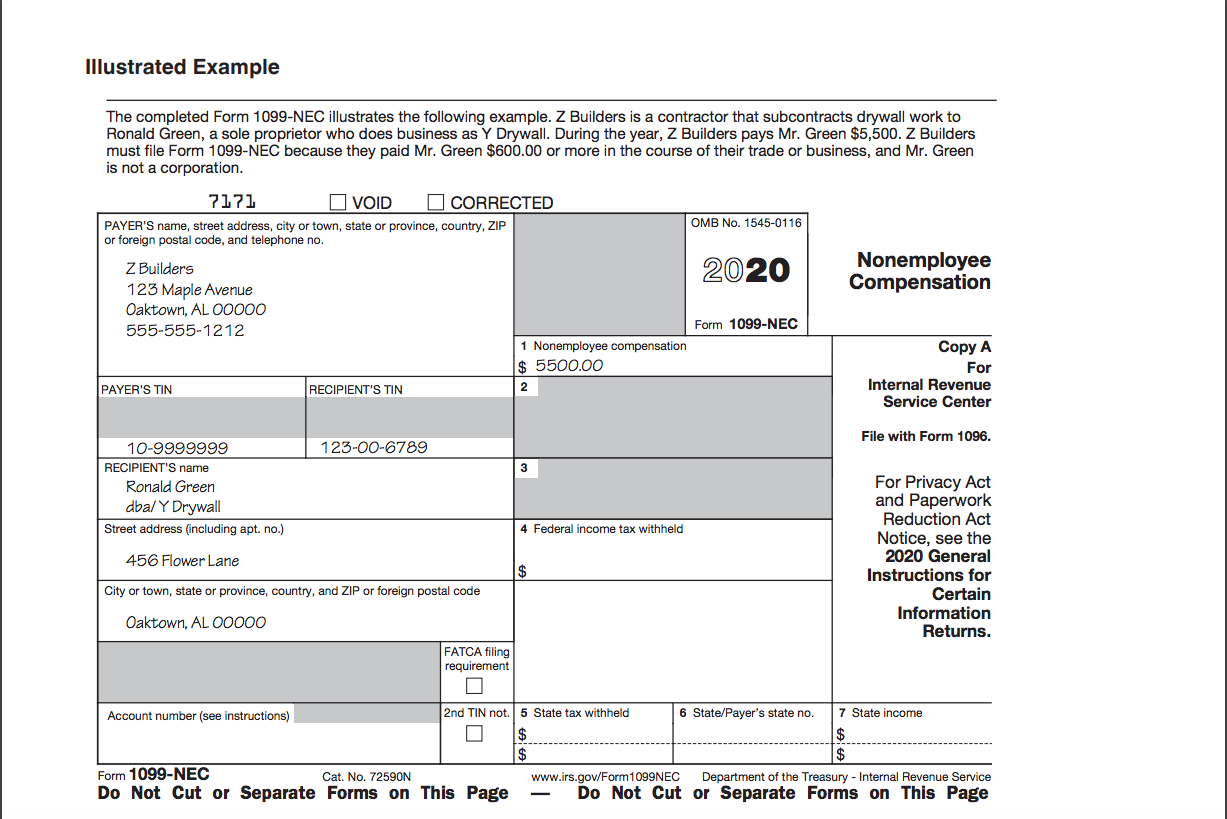

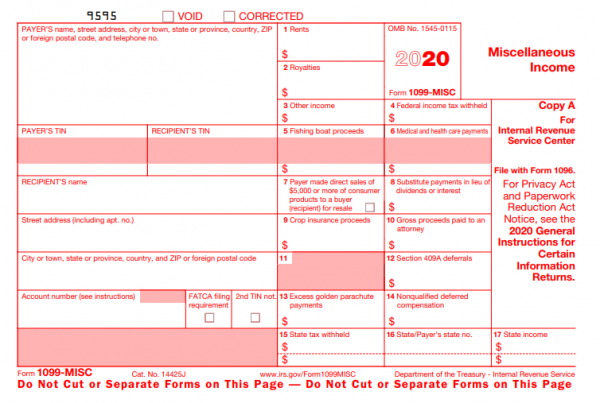

1099 form independent contractor example-CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the other Form 1099MISC vs Form 1099NEC In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensationBusiness owners used to report nonemployee compensation on Form 1099

1099 Form 19 Pdf Fillable

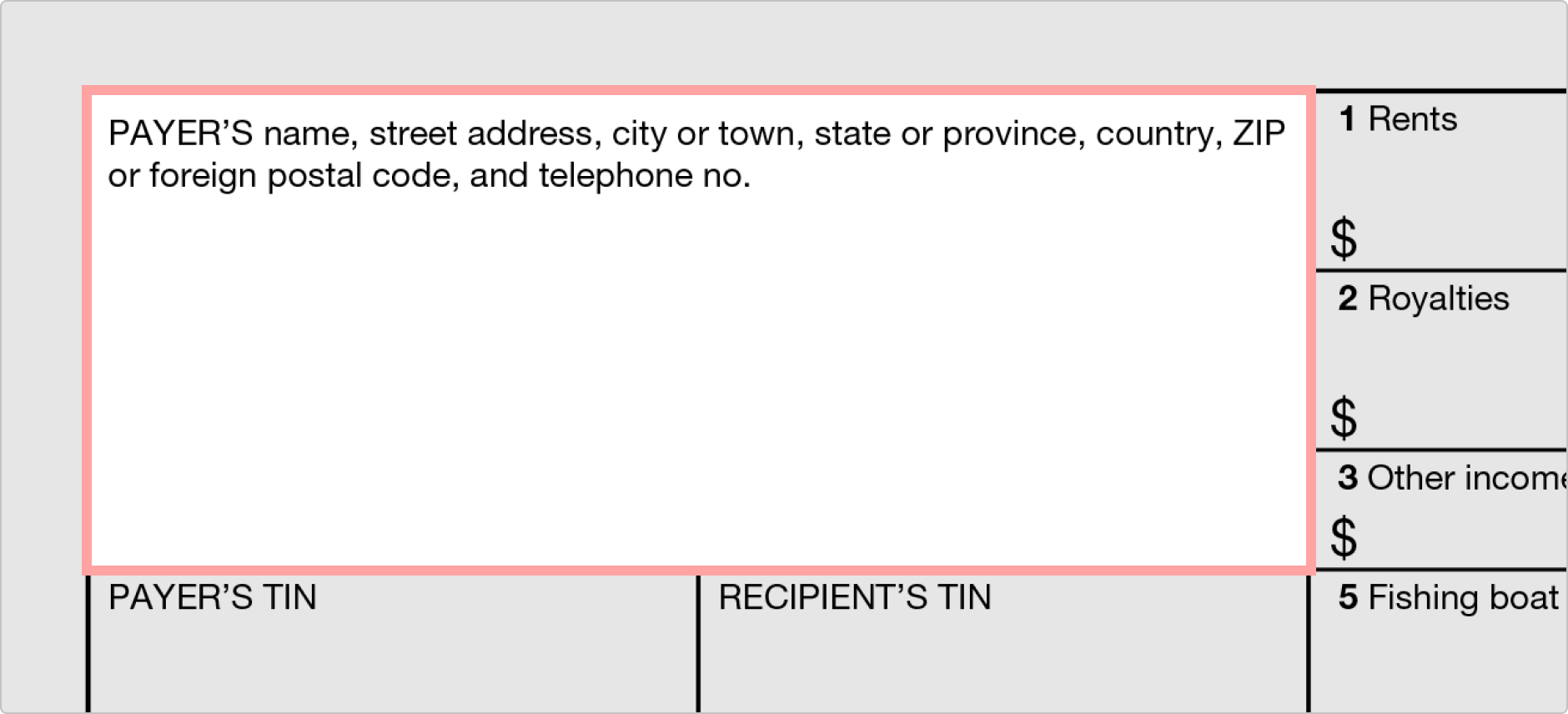

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees Form 1099MISC is the most common type of 1099 form 1099MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment For example contractors It can also be used to report royalties, prizes, and award winnings 21 Gallery of Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent Contractors

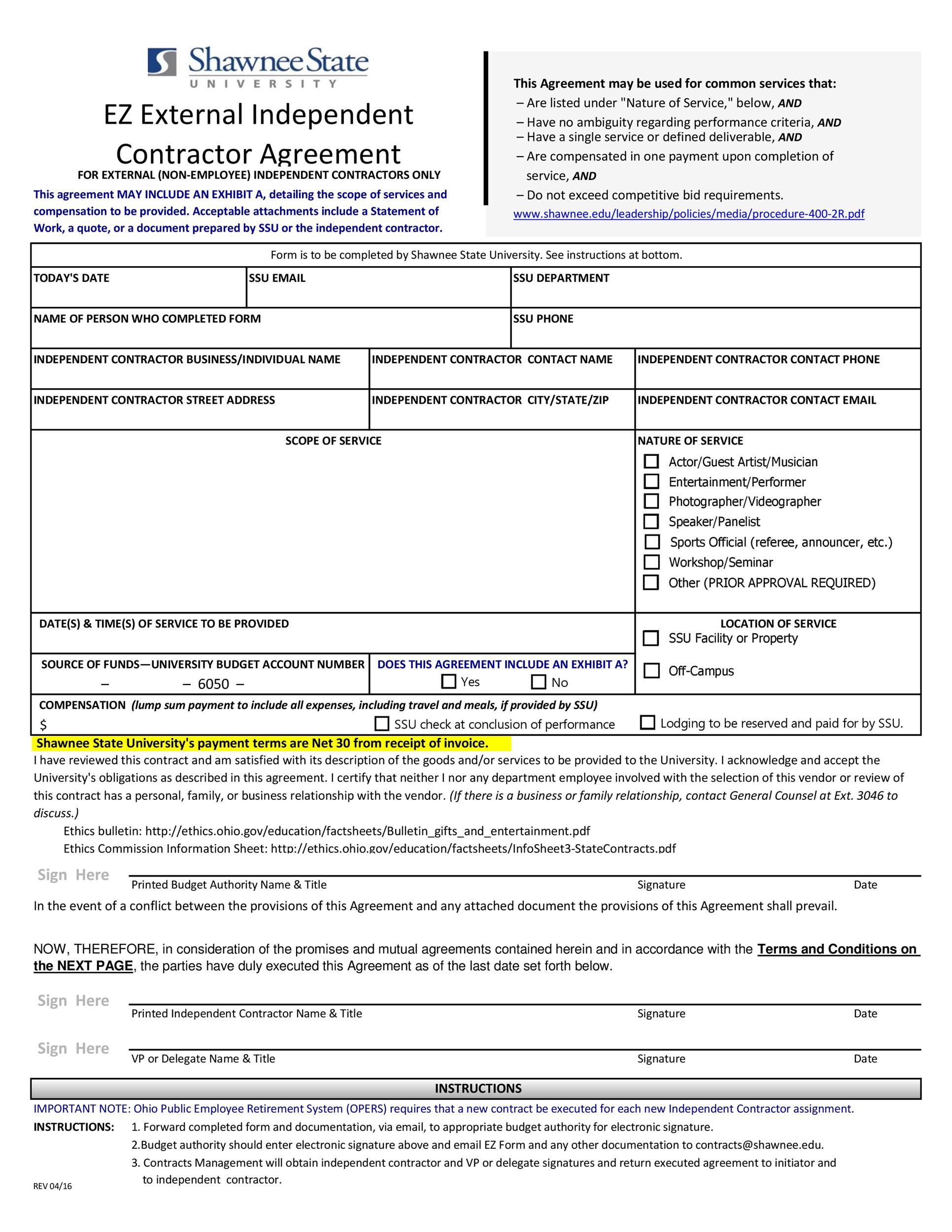

Sample Independent Contractor Agreement Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, personal injury, broad form property damage, contractual liability, and crossliability Before commencing any work, A The form is used to report payments of at least $600 to any service provider (ie, contractor, freelancer, consultant) who isn't an employee If the service provided was less than $600, you don't need to file a 1099MISC One monthly payment of $300 wouldn't require you to file the form, for example Agreement for Independent (IRS Form 1099) Contracting Services Review List This review list is provided to inform you about this document in question and assist you in its preparation You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit

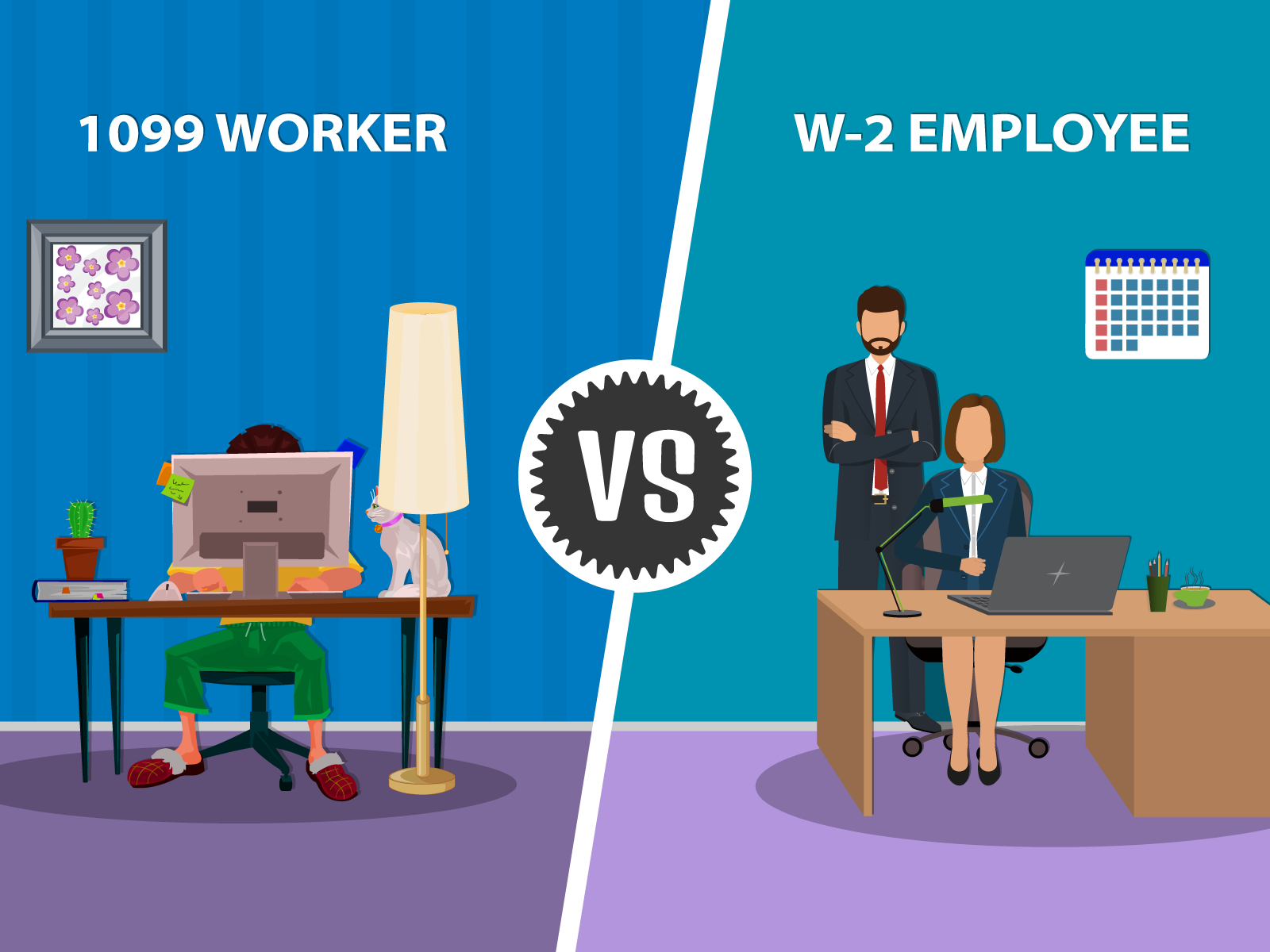

For example, you can save time by using the bulkupload feature to import all of your independent contractor information at once Also, forget about heading to the post office!If you hire independent contractors yourself, such as a designer to create a brochure or a web developer to build a website, you can claim a tax return on their fees Again, if you pay them more than $600 within a tax year, fill in a Form 1099NEC1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax returnThe employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work

Form 1099 Misc It S Your Yale

How To Pay Contractors And Freelancers Clockify Blog

1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer Whether it's cash dividends paid by a company that owns a stock or interest accrued from a bank account, a taxfree 1099 can be issued 1099 Form IndependentWhen a company is willing to take the service of another independent business or professional, it has to formalize the agreement with an independent contractor agreement form The independent contractors are not employees of the company and have got a separate set of rules and regulations to follow which is different from the office staff and this agreement provides aGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

Ready For The 1099 Nec

How To Prepare Form 1099 Nec When You Employ Independent Contractors Quickbooks

For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor; 25 Little Known 1099 Independent Contractor Deductions Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies Like a sign advertising "Toys for Tots sponsored by KeeperTaxcom, for example 930 SAMPLE Independent Contractor Agreement Forms & Templates in PDF MS Word Rating An independent contractor comes with a varied assortment of perks that fulltime employees cannot provide In addition to saving you from certain expenses and providing flexibility to your staff capacity, there's also the reduced chances of lawsuits in play

Dealing With Fraudulent Or Incorrect 1099 Robinson Henry P C

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Here, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application processAfter reviewing the quality of your work over the past three weeks, I have decided to terminate our independent contractor agreement effectiveAn independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRS

Free Independent Contractor Agreement Templates Pdf Word Eforms

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive Agreement for Independent (IRS Form 1099) Contracting Services Review List This review list is provided to inform you about this document in question and assist you in its preparation You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

A 21 Guide To Taxes For Independent Contractors The Blueprint

Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because itsSample independent contractor agreements are available online If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns inForm 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds

Small Business Tax Preparation For Independent Contractors

How To File 1099 Misc For Independent Contractor Checkmark Blog

They waive any rights as an employeeDownload Nursing Agreement SelfEmployed Independent Contractor right from the US Legal Forms site It gives you a wide variety of professionally drafted and lawyerapproved documents and samples For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses If you operate a business in the Sharing Economy or if you work as an independent contractor, like driving for Uber or working freelance on Upwork, the income you earn and the

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Your Ultimate Guide To 1099s

Independent Contractor Defined People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors However, whether these Independent Contractor Termination Letter Sample Independent Contractor Termination Letter Sample Industrial Maintenance Mechanic Recommendation Letter;Independent contractors are responsible for ensuring that they and their subcontractors operate within State law, pay their income tax, and obtain necessary insurance coverage The agreement must be signed by both parties in order to be considered valid

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

1099 Form Independent Contractor Free

The 1099 Form, Explained and Annotated When you're a small business owner issuing tax forms to an individual, there are two different forms you can use If the person in question is your employee, you fill out a W2 form If the person isn't your employee, however—if they're an independent contractor, for example—you fill out a 1099Independent Contractor Information Form palletizedtruckingcom Details File Format PDF Size 393 kB Download This form is used by the authorities of the state to gather information about the independent contractors operating in their area The contractor is required to fill in all the relevant details about himself and his services inIn a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors need to report these payments on their tax returns as well For example, if you hire a website developer on a contract basis to develop a website for your business and paid $00 for their

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Barber Shop Owners Need To Know About The W 9 And 1099 Tax Forms Barber Accountant

In addition to the IRS forms that an independent contractor must file, their clients and employers are required to submit information regarding their transactions as well Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details the transaction, as well as A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099It's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

Independent Contractor Agreement Example

What Are Irs 1099 Forms

Independent contractor status can apply regardless of how your business is structured You could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company, or LLC, or adopt a corporate structure As long as you're not classified as an employee, you can be considered an independent contractorHiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups for Form 1099NEC vs 1099MISC Form 1099NEC is reserved for individuals who provide you with services but who don't work for you as an employee It's also used for attorneys under some circumstances, and for anyone from whom you purchase fish or "other aquatic life," but only if you make the purchase with cash and the individual is someone whose business is

What Is The Difference Between A W 2 And 1099 Aps Payroll

3

For example, if you earn $15,000 from working as a 1099 contractor and you file as a single, nonmarried individual, you should expect to put aside 3035% of your income for taxes Putting aside money is important because you may need it to pay estimated taxes quarterly The key thing to note for independent contractors is that selfemploymentFor example, a 1099 for a contractor that worked with you in 15 must be issued to the contractor by Additionally, you must send the red copy of it to the IRS by the last day of February by mail, or by March 31 if you are doing so electronically To whom do I send a 1099misc form? Payers use Form 1099MISC, Miscellaneous Income or Form 1099NEC, Nonemployee Compensation to Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600

Independent Contractor Taxes Guide 21

3

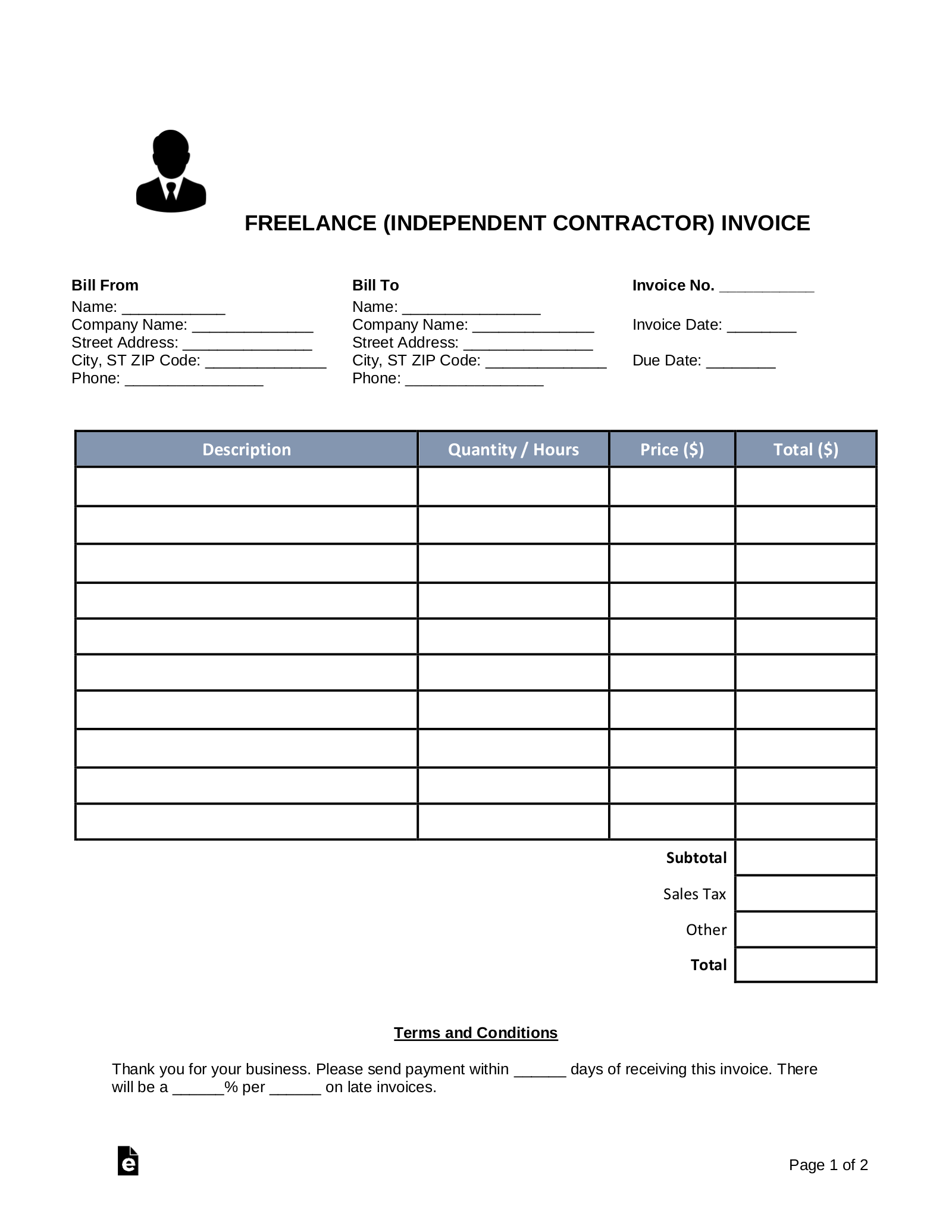

The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of theFor most independent contractors, calculating your PPP borrowing limit is a 3step process Step 1 Find line 31 on your 19 IRS Form 1040 Schedule C (If you haven't filed yet for 19, go ahead and fill it out) If the amount on Line 31 is over $100,000, write $100,000 Step 2 Divide the amount from Step 1 by 12

1099 Form Independent Contractor Free

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Irs Form 1099 Reporting For Small Business Owners In

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 K Stride Blog

How To File 1099 Misc For Independent Contractor Checkmark Blog

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Instant Form 1099 Generator Create 1099 Easily Form Pros

Free Independent Contractor Agreement Free To Print Save Download

Self Employed And Taxes Deductions For Health Retirement

1099 Misc Form Fillable Printable Download Free Instructions

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Www Irs Gov Pub Irs Pdf I1099msc Pdf

1099 Form 21 Printable Fillable Blank

Create An Independent Contractor Agreement Download Print Pdf Word

1099 Misc Form Fillable Printable Download Free Instructions

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

50 Free Independent Contractor Agreement Forms Templates

3

1099 Form 19 Pdf Fillable

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

What Are Irs 1099 Forms

1099 Nec And 1099 Misc Changes And Requirements For Property Management

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Free Independent Contractor Agreement Pdf Word

1099 Misc Form Reporting Requirements Chicago Accounting Company

1099 Workers Vs W 2 Employees In California A Legal Guide 21

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Irs Form 1099 Reporting For Small Business Owners In

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Diligent Recordkeeping Key To Surviving Tax Time For Self Employed Taxpayers Hackensack New Jersey Self Employed Tax Lawyer Samuel C Berger Pc

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor 101 Bastian Accounting For Photographers

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

Freelancers Meet The New Form 1099 Nec

Form 1099 Misc It S Your Yale

1099 Form 19 Pdf Fillable

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Who Are Independent Contractors And How Can I Get 1099s For Free

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

New Form 1099 Reporting Requirements For Atkg Llp

How To Fill Out A W 9 19

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Misc Instructions And How To File Square

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

What Is The Account Number On A 1099 Misc Form Workful

Form 1099 K Wikipedia

What Tax Forms Do I Need For An Independent Contractor Legal Io

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

How To File 1099 Misc For Independent Contractor Checkmark Blog

50 Free Independent Contractor Agreement Forms Templates

1099 Form Fileunemployment Org

1099 Form Independent Contractor Free

What Is A 1099 Contractor With Pictures

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Independent Contractor Agreement Template Free Pdf Sample Formswift

What Is The 1099 Form For Small Businesses A Quick Guide

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Form Independent Contractor Free

17 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

How To Fill Out A 1099 Misc Form

How To File 1099 Misc For Independent Contractor Checkmark Blog

0 件のコメント:

コメントを投稿